Invention Survey

Use surveys to test and confirm your assumptions about the market for your invention.

The single most important thing for new product success is a critical mass of customers.

More than a patent or a cool design, more important even than funding, is a critical mass of customers. Almost everything else has a solution. However, if there are not enough customers for your invention, if not enough people feel the itch and the need to scratch it, then your invention will fail. Game. Set. Match. Do not even start the competition. You lose even before you start.

How do you confirm there will be customers? You start with a survey. Surveys are difficult to do well, especially if you are hoping for a specific answer. As the inventor you are likely to ask questions in a way that will get you answers you want to hear. This is especially true when you ask friends and family in person; but it also extends to strangers you might ask face to face, and even to online surveys where you create the presentation and write the questions yourself. Hiring a third party to run your survey helps ensure that it's done right.

Invention City uses surveys to follow up on Brutally Honest Reviews to decide how much to invest in a new product idea and to reconsider ideas we previously declined (examples upon request). We also use surveys to better identify target markets and perfect the images and headlines we use for advertising. We can do the same for you. Click on the button below to get started:

The trick to doing a survey well is to present everything in a neutral manner. You can do it yourself if you pay attention to being neutral and follow these guidelines:

- Use an online platform like Survey Monkey to host your survey. Online surveys avoid the biases typical of face-to-face surveys.

- Use a template or follow an example to develop your questions. Survey Monkey's New Product Survey Template is a great way to start - but it is missing the critical question...

- The critical question: "Would you actually buy this product for $______ ?

a) Yes. I'd buy it today.

b) Probably. I'd buy it in the next week or two.

c) Maybe in the future.

d) Never. - If you do not have a cost/price, set the price for the question above at the price you find for items of similar complexity on Amazon or other online site.

- As a rule, you should have at least 100 responses - after filtering - for the survey to have rough validity. For mass market products this typically means 200 respondents.

- If you get 60% or more (within your target market) checking off "Today" and "Probably", you have reason to feel encouraged. If less than 50%, you will want to take a closer look and maybe reconsider (note that these answers are a "hotness indicator", a guideline to possible success, not a forecast of sales)

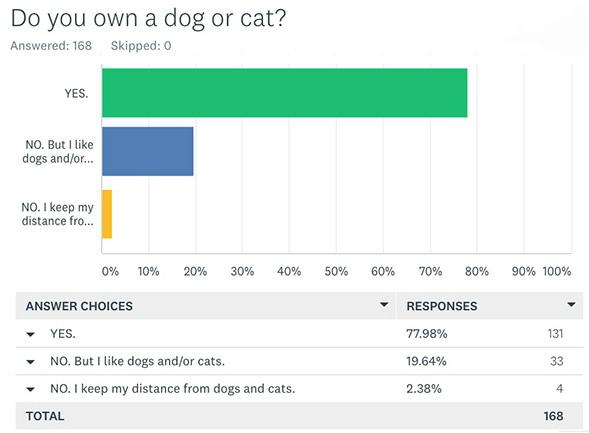

- Ask filtering questions to help in identifying the target market.

The questions will be asked in response to a presentation. For most products this is another reason to favor online surveys over face to face. Most products are sold via Internet or in a package on a store shelf; the product must sell itself without a salesperson making the pitch and doing a demo. Thus, an online presentation more closely matches the reality of how the product will be sold and will generate better data than a face to face survey. That said, making an effective online presentation is hard. It needs to be short and easy to understand. Simple looking things are harder to create than complex ones. We favor short videos (1-2 minutes) over static sales/sheets. But there is a lot of validity to making the presentation in the format of a listing on Amazon. Again, just as in creating and running the survey itself, a good presentation is hard for inventors to do on their own and professional help can be a good investment.

In some cases you may want to present a competitive product alongside your invention and ask survey questions comparing the two. A great way to get the attention of a possible licensee is to show how one of their existing products surveyed against your invention (presuming yours did better!).

One last thing, before making a public disclosure in a survey, you should take steps to protect your idea. This can mean filing a provisional patent application or trademark or other steps.

The Value of Face to Face Surveys

Face to face surveys are great when you have a working prototype and are seeking feedback on how it functions. There is no better way to understand how a user will interact with your product than to simply hand it to them, sit back, and watch. The face to face survey can be used for marketing feedback as well. When WorkTools first developed the forward action staple gun that became the Black & Decker Powershot®, Mike Marks sat in front of a lumber yard and asked customers to compare the prototype versus the market leading Arrow T-50. He asked people to fire three staples with the T-50 and 3 staples with what was then called the CounterPoint, and gave them a $5 drill chuck for answering 5 questions. When 49/50 said they preferred the CounterPoint he knew that WorkTools created a winner. He also learned that getting people to fire the new staple gun in the right direction would be a big challenge and much of the future design effort went toward creating directionality for a tool that worked opposite the industry standard.

Face to face surveys with friends and family are also great for when you're first starting and want to keep the invention more or less secret. You need to consider that the feedback will likely be more positive than real world feedback but it is still useful.

Here's how you do it:

Select a number of people with whom you feel comfortable disclosing your invention. They will be asked to express their opinions about your invention. It is important that these people be honest in their responses, regardless of whether the responses are good or bad for your invention. Make enough copies of the Survey Form so that each person you survey receives a new form (without someone else's answers). Show your invention ideas or, preferably, a prototype or model of your invention. This is the first step in market research. Ideally you should survey more than 20 people (the more people you survey and the better they represent your target audience, the more meaningful your results will be). Remember that responsibility for maintaining confidentiality is yours. To be safe, you may want to ask the people you survey to sign a confidentiality agreement. However, if your evaluators are friends and family this might prove both awkward and unnecessary.

Click here for the print-formatted version of the form.

Once you have performed the survey add up the numbers for each response onto a single sheet. Divide the total number for each response by the number of people you surveyed. This determines the average response value for the question.

For example, you surveyed 10 people. Question 1 received the answers: 5,5,8,7,9,10,6,6,2,7 The total of these numbers = 65. Divide 65/10 = 6.5. 6.5 is the average value for question #1.

To really do your homework properly you should perform a second survey with the same people. This time show them a currently marketed product that competes with yours (something that solves the same/similar problem). The function and features of the product could be entirely different. When choosing a competitive product to survey choose one that a user might buy instead of yours if he/she saw both items on a shelf next to each other.

Be sure that your evaluators understand they should answer questions from their OWN perspective only. You do not want evaluators making assumptions that "other people will buy it". To be useful answers must be honest and personally true.

Now compare the values of the answers for your invention with those for the competitive product. Do you have a winner?

Survey results help in making a decision on whether to proceed with an invention and are useful when making presentations to potential partners, investors, licensors etc. When someone asks how you know the invention is a good idea you can answer with your survey results.

To better understand the importance of surveys like this one read the Invention City article Money and Inventing.

Survey Form

The following survey will be used in evaluating the market potential of an invention that has been disclosed to you. An honest, unbiased reply is necessary. The inventor will use your answers to help in determining whether or not he/she should proceed. Proceeding will cost the inventor a lot of time and money. Answering honestly is the best way to help the inventor make a good decision. Please answer the questions only for yourself - the inventor needs YOUR opinion about what the invention means to YOU. Do not consider how others might answer the questions.

For each question, please circle a number from 1 to 10. 1 is low or "not at all". 10 is high or "absolutely".

1. Do you currently own or use products that are similar, competitive, alternative, or related to the invention?

none ...1...2...3...4...5...6...7...8...9...10... many

2. Compare the invention to similar, competitive and alternative products:

it's worse ...1...2...3...4...5...6...7...8...9...10... it's better

3. Does this invention solve a problem you've experienced?

no problem ...1...2...3...4...5...6...7...8...9...10... solves big problem

4. Would you like to buy the invention today?

never buy ...1...2...3...4...5...6...7...8...9...10... buy this instant

5. Compared to similar, competitive or alternative products, would you pay more or less for the invention?

pay much less ...1...2...3...4...5...6...7...8...9...10... pay much more

6. Consider the potential safety hazards to yourself and others when using this invention. How do you consider it?

dangerous ...1...2...3...4...5...6...7...8...9...10... completely safe7. Comments and suggestions:

share this article: facebook